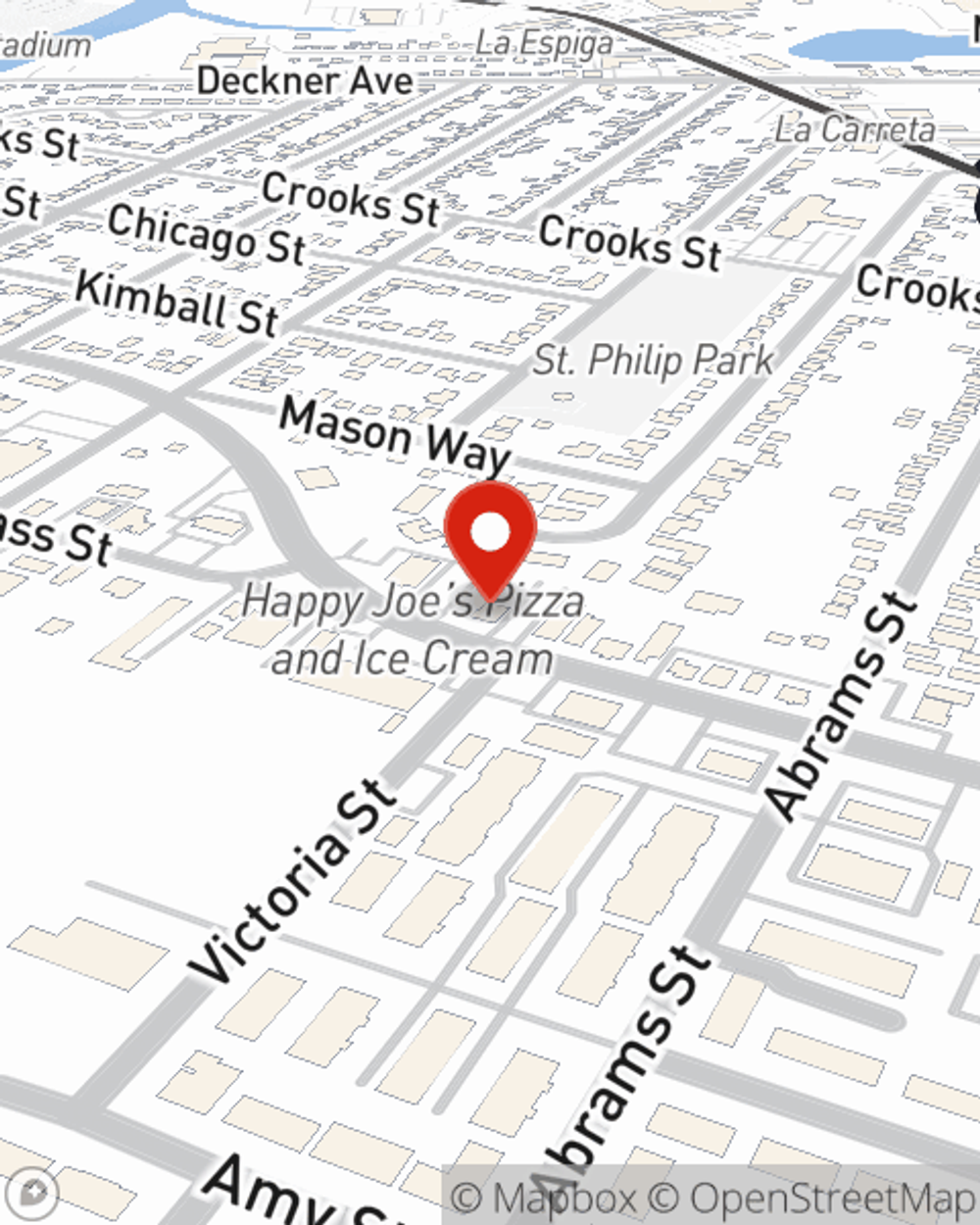

Business Insurance in and around Green Bay

One of the top small business insurance companies in Green Bay, and beyond.

Helping insure businesses can be the neighborly thing to do

- Brown County

- Kewaunee County

- Oconto County

- Outagamie County

- Manitowoc County

- Calumet County

- Door County

- Shawano County

- Winnebago County

- Fond du Lac County

- Marinette County

- Waupaca County

- Langlade County

- Sheboygan County

- Green Bay

- Appleton

- Oshkosh

- Sheboygan

- Fond Du Lac

- Manitowoc

- Neenah

- Grand Chute

- Kaukauna

- Ashwaubenon

Insure The Business You've Built.

The unexpected happens. It's always better to be prepared for the unfortunate catastrophe, like an employee getting injured on your business's property.

One of the top small business insurance companies in Green Bay, and beyond.

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

Protecting your business from these possible problems is as easy as choosing State Farm. With this small business insurance, agent Brad Prentice can not only help you devise a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

Don’t let the unknown about your business stress you out! Visit State Farm agent Brad Prentice today, and learn more about how you can save with State Farm small business insurance.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Brad Prentice

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.